Airtel Payments Bank Q3 revenue up by 47% to Rs. 469 Crore

Telugu super news,India,Febuary 9,2024: Airtel Payments Bank, India’s only profitable multi-segment fintech operating at scale with a banking license, today announced its consolidated results for the third quarter ended December 31, 2023.

The Bank continued to witness a strong growth trajectory with revenues at Rs. 469 crore, up by 47% YoY, while net profit stood at Rs. 11 crore, up by 120% YoY. The Bank’s Monthly Transacting Users (MTU) grew to 59 million giving a boost to customer deposits, which grew by 50% YoY to Rs. 2,339 crore during the quarter. The Bank’s annualised Gross Merchandise Value (GMV) stood at over INR 2,628 bn. The Bank also witnessed an increase in uptick in fee income, driven by newly launched products including debit card and savings bank account.

Commenting on the results, Anubrata Biswas, MD and CEO of Airtel Payments Bank said, “We have delivered yet another quarter of consistent and competitive growth backed by a surge in customer demand for our safe digital products including savings bank account, debit card and other offerings including FASTag. Compliance continues to be the bedrock of everything we do as a bank, and we are confident that this will help us stay on course to be India’s only profitable fintech”

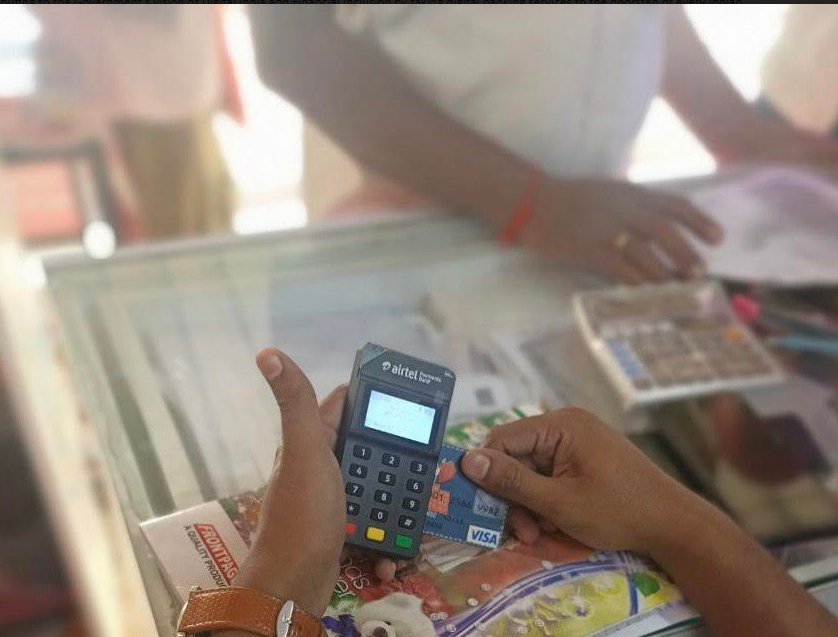

With Safety being a prime concern in this digital world, customers have found the Bank’s safest digital account offering beneficial, with a higher number of customers using it as their secondary account for daily and monthly payments. Airtel Payments Bank continues to register healthy demand for its digital offerings and customised account plans.

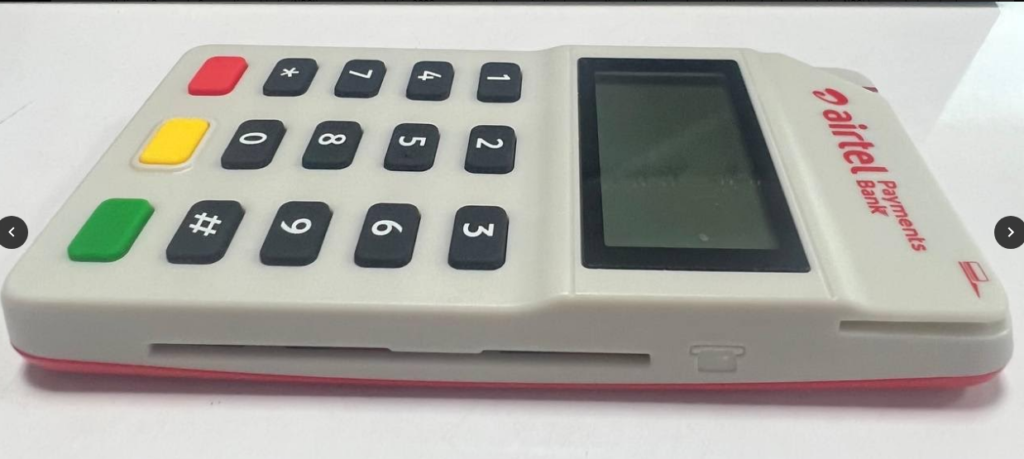

Airtel Payments Bank has three clear segments in which they serve customers across geographies – the Urban Digital, the Rural Underbanked, and Industries & Businesses. They offer complete end-to-end digital banking solutions along with a bouquet of digital financial services – insurance, lending, and investment solutions. Airtel Payments Bank now processes over 7 billion annualised transactions across its platforms, making it the fastest-growing digital bank. The Bank is solving the problem of access by taking banking to the deep rural pockets of the country with the largest retail-banking network of 500,000 neighbourhood-banking points. Today, Airtel Payments Bank is also the largest micro cash player in the country, with more than 3,000 corporate partners. Here, the Bank is in a rare space of solving for last-mile cash digitization by utilizing its distribution and technology.